Send vehicle gift letter via email, link, or fax. You can also download it, export it or print it out.

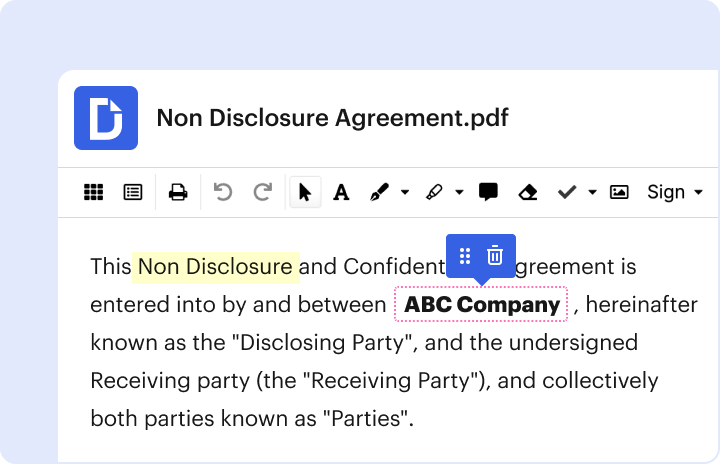

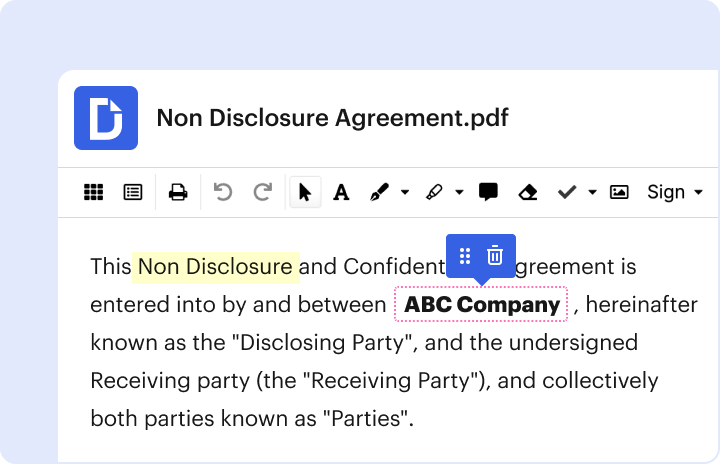

With DocHub, making changes to your documentation requires only a few simple clicks. Make these fast steps to change the PDF Vehicle gift letter online for free:

Our editor is super easy to use and effective. Try it out now!

Fill out vehicle gift letter onlineWe have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

How do I give a car as a gift?How to gift a car Pay off your car loan. . Think about the giftee's financial situation. . Make sure you can afford to pay gift tax. . Don't worry about sales tax if you already own the car. . Write up a bill of sale. . Transfer your car title. . Insure the giftee. . More coverage from How to Do Everything: Money.

How do I gift a car in Rhode Island?Complete the Affidavit of Gift of Motor Vehicles form if the vehicle is a gift; A completed and signed Application for Registration (TR-1) form; A completed and signed Sales Tax Form (T-334-2) form OR Sales or Use Tax Exemption Certificate(T-333-1) form; A completed and signed Sole Heir Affidavit form.

Do I have to pay taxes on a gifted car in Texas?A $10 tax is due on a gift of a motor vehicle to an eligible party. The gift tax is the responsibility of the eligible person receiving the motor vehicle, and the person pays the gift tax to the county tax assessor-collector (CTAC) at the time the person titles and registers the motor vehicle.

How do I give a new car as a gift?How to gift a car Pay off your car loan. . Think about the giftee's financial situation. . Make sure you can afford to pay gift tax. . Don't worry about sales tax if you already own the car. . Write up a bill of sale. . Transfer your car title. . Insure the giftee. . More coverage from How to Do Everything: Money.

How do you write a gift letter for a car?The gift letter should describe the vehicle that is being gifted. Example: \u201cI, (your name), gift to my friend, (friend's name), the following vehicle: Year, Make, Model and VIN.\u201d The gift letter will need to be notarized, since your friend is not considered immediate family per the R.I. Division of Taxation.

rhode island vehicle gift letter vehicle gift letter florida ri dmv gift letter immediate family vehicle gift letter washington state